About KORE US REIT

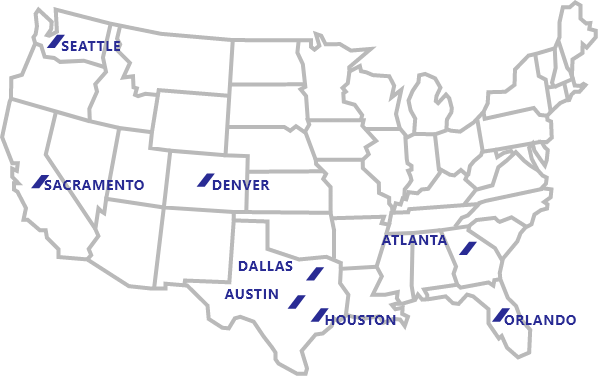

KORE US REIT (Keppel Office Real Estate US REIT or KORE) is a distinctive US office REIT with freehold office buildings and business campuses located across key growth markets, characterised by strong economic fundamentals and attractive lifestyle attributes. KORE US REIT aims to be the first-choice US office S-REIT, delivering sustainable distributions and strong total returns to Unitholders.