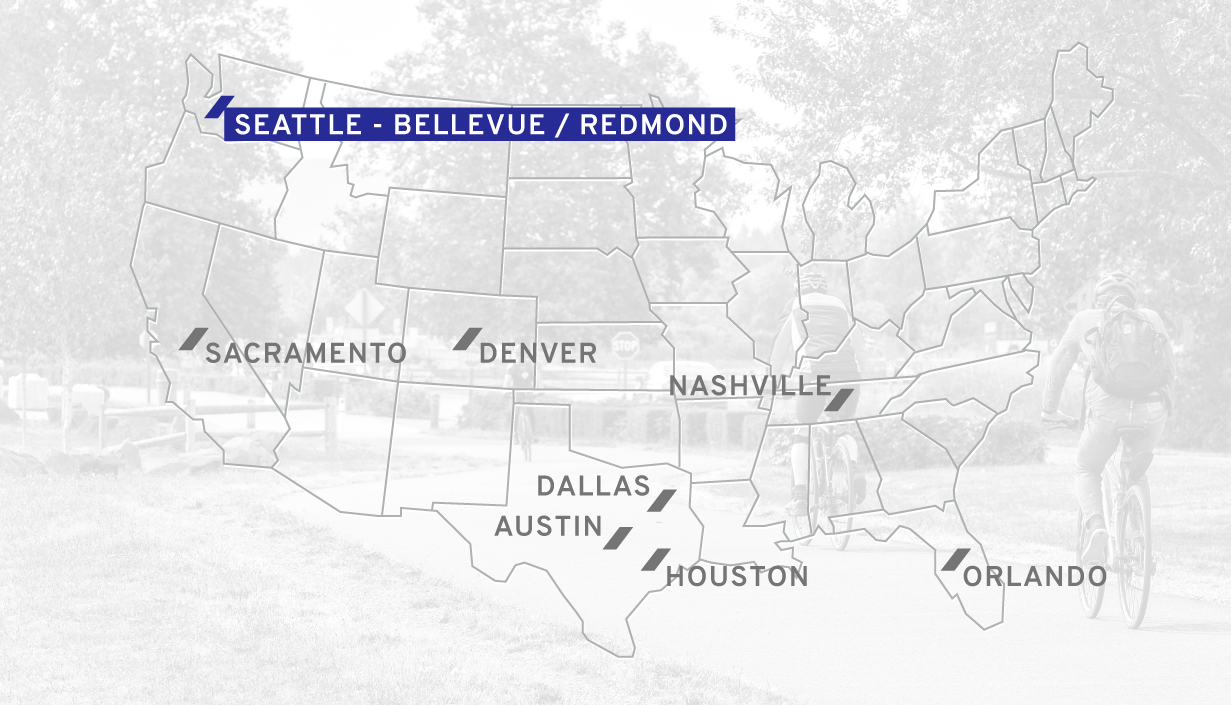

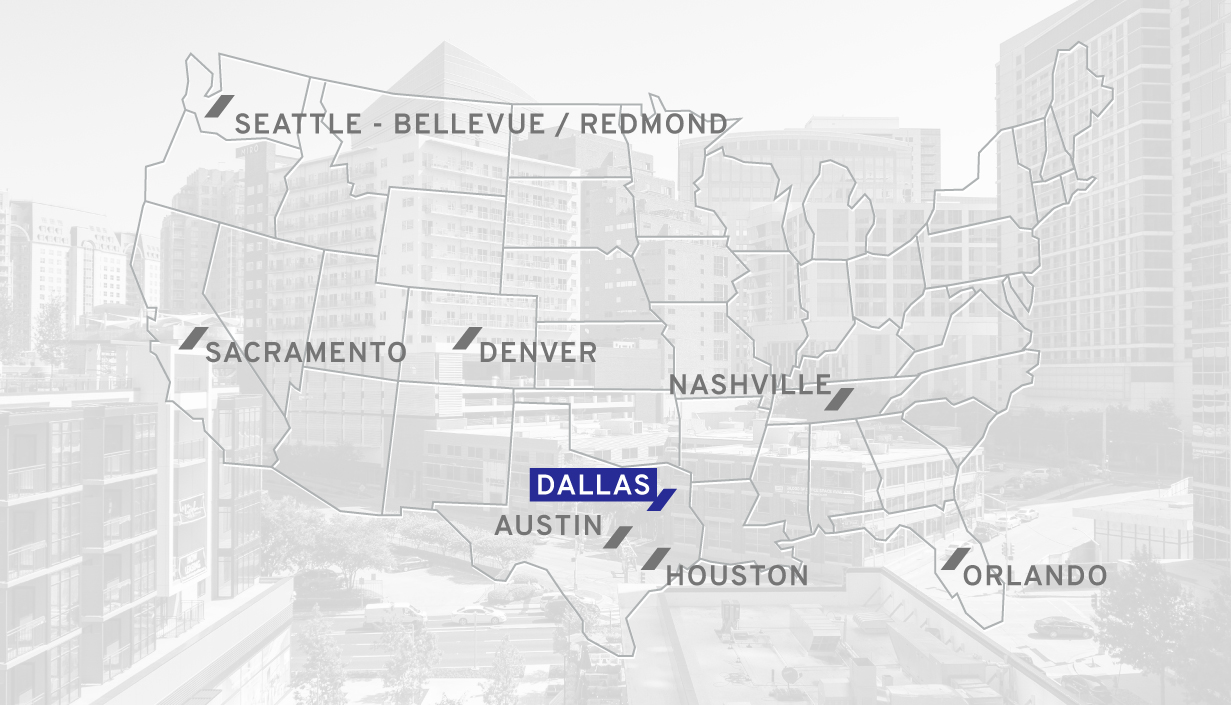

US PORTFOLIO SHOWCASE

Distinctive portfolio of quality freehold office buildings and business campuses across eight growth markets in the US.

Distinctive portfolio of quality freehold office buildings and business campuses across eight growth markets in the US.

Key growth markets with positive economic and office fundamentals

Exposure to the fast-growing TAMI, medical and healthcare sectors

Attractive location and on-site amenities that decision makers and talent desire

High quality lease and financing structures that offer stability

Proximity to prestigious universities and educated talent pools

Accessibility to alternative transit options